Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

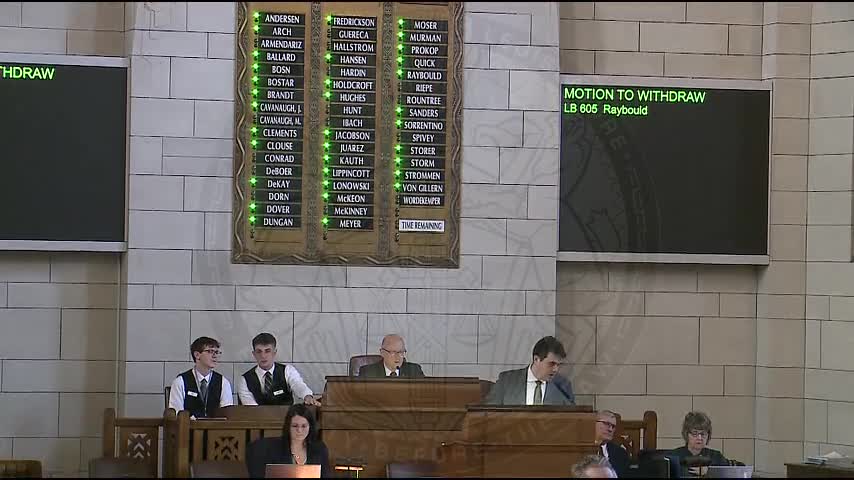

Pure Food Act update and fee schedule draw scrutiny; bracket motion filed

Debate over single license plate and fees surfaces during LB97; amendment delays change to 2029

Nebraska Legislature advances multiple bills on final reading; several pass with emergency clauses