Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

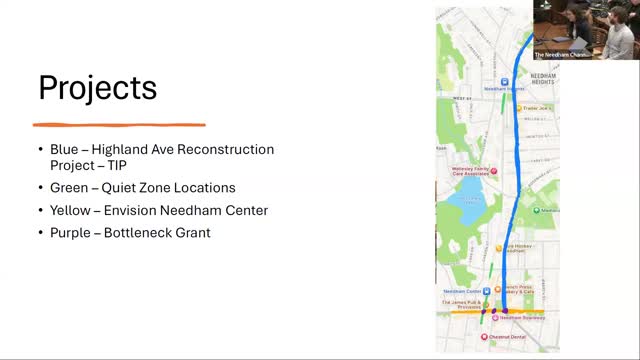

Town updates on Highland Ave TIP, Envision Needham Center pilot, MBTA quiet‑zone work and bottleneck signal grant

South Street water‑main project to add stormwater BMPs; 15 street trees will come down with 2‑for‑1 replacement planned

Needham Select Board closes public hearing on proposed black-plastic ban and ‘Skip the Stuff’ warrant articles

Needham joins regional talks as municipal solid‑waste contract nears 2028 expiration; recycling and food‑waste programs face market pressure

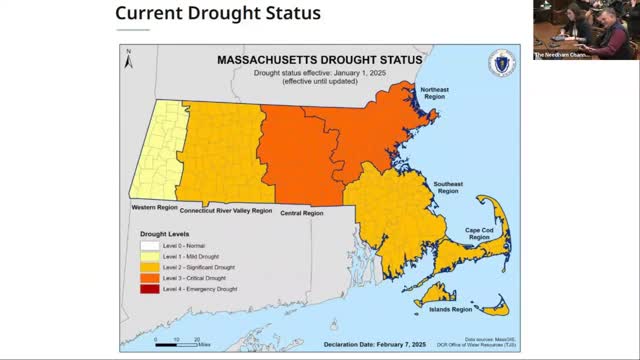

Public works briefs Select Board on possible state‑required outdoor water restrictions; delegation motion withdrawn