Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

Votes at a glance: key bills the Oklahoma House passed March 5

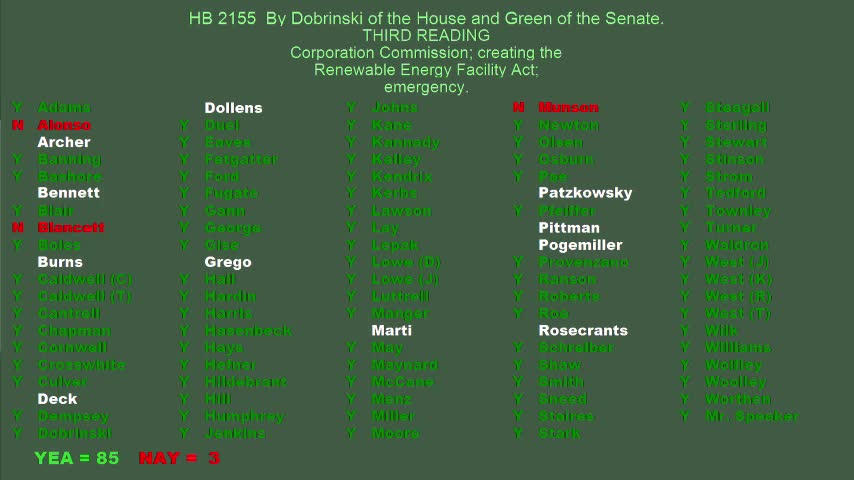

House passes bill to let Corporation Commission set permitting rules for renewable energy facilities

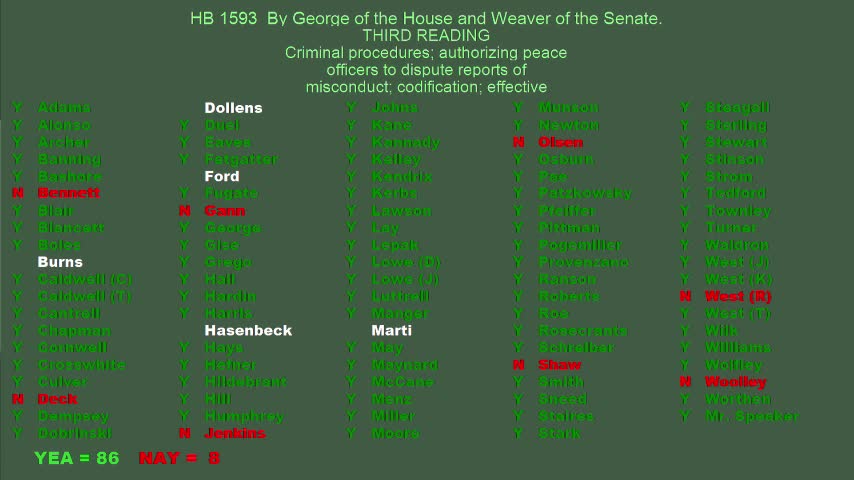

House adds school resource officers and contract security guards to criminal protections for school employees