Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

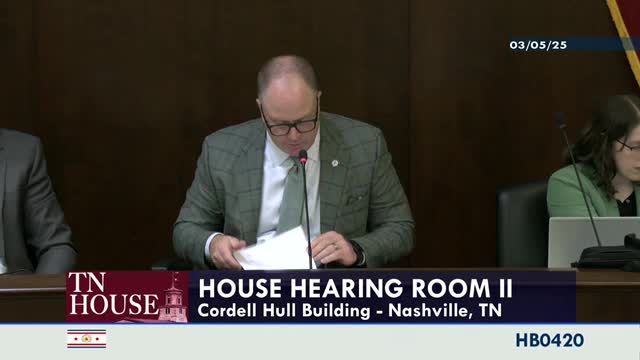

Subcommittee amends online subscription transparency bill, delays final action (House Bill 420)

Subcommittee approves higher acquisition charges for small‑loan classes, sends bill to full committee (House Bill 775)