Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

City studies school‑zone speed cameras after pilot data; staff to clarify permitted uses of revenue under state law

Council signals interest in studying citywide transportation impact fees; staff to return with refined analysis

Spokane Valley proposes right-of-way permit fee increases to fund additional inspector as fiber and utility work strains staff capacity

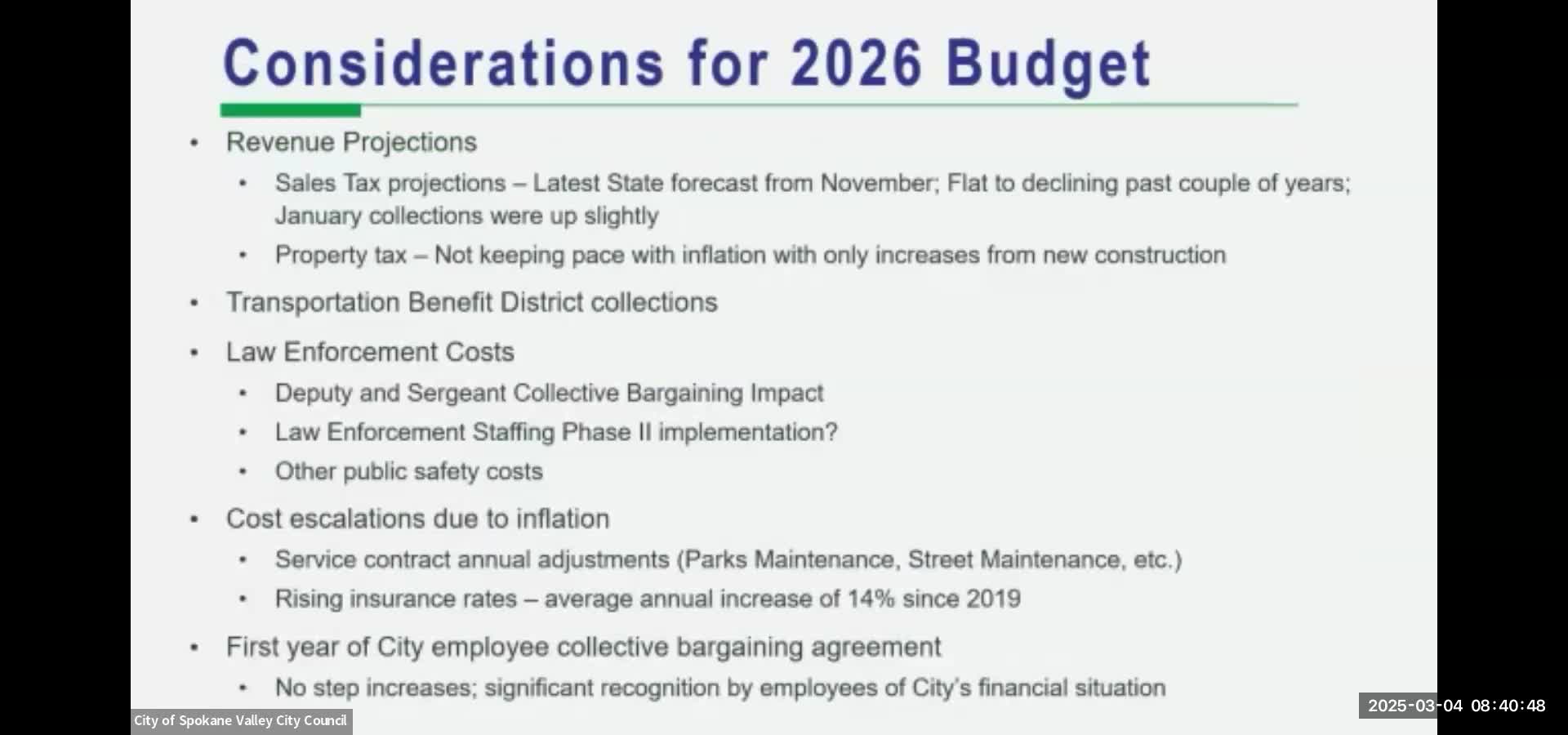

Spokane Valley staff outlines revenue options, warns of tight ballot calendar for voter measures

Sheriff’s contract, cost increases and a proposed Phase 2 push Spokane Valley to study indirect rates and staffing cost recovery

Transportation Benefit District revenue falls short after state estimating glitch, staff warns