Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

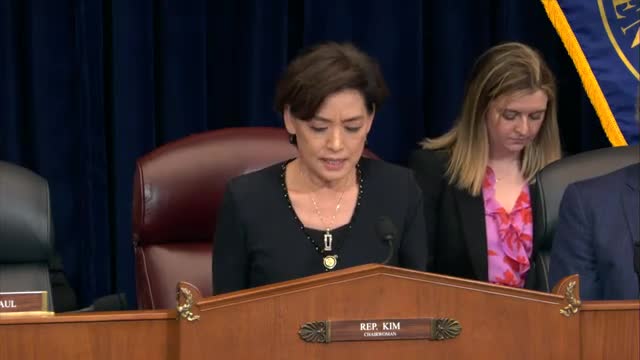

Committee hears experts urge tougher screens on outbound investment and stronger economic offers to counter China

Subcommittee hears bipartisan calls to deepen alliances, accelerate defense industrial cooperation in Indo‑Pacific