Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

House Finance reports three bills out of committee; votes recorded on HB 1261, HB 1127 and HB 1983

Heated hearing on $2 device excise for digital equity; business groups oppose, education and community groups support

Committee hears long briefing on technical changes to Washington capital gains tax; CPAs and DOR sign off on language changes

Bill to tax short‑term rental platforms for affordable housing gets hearing; staff estimates large local transfers

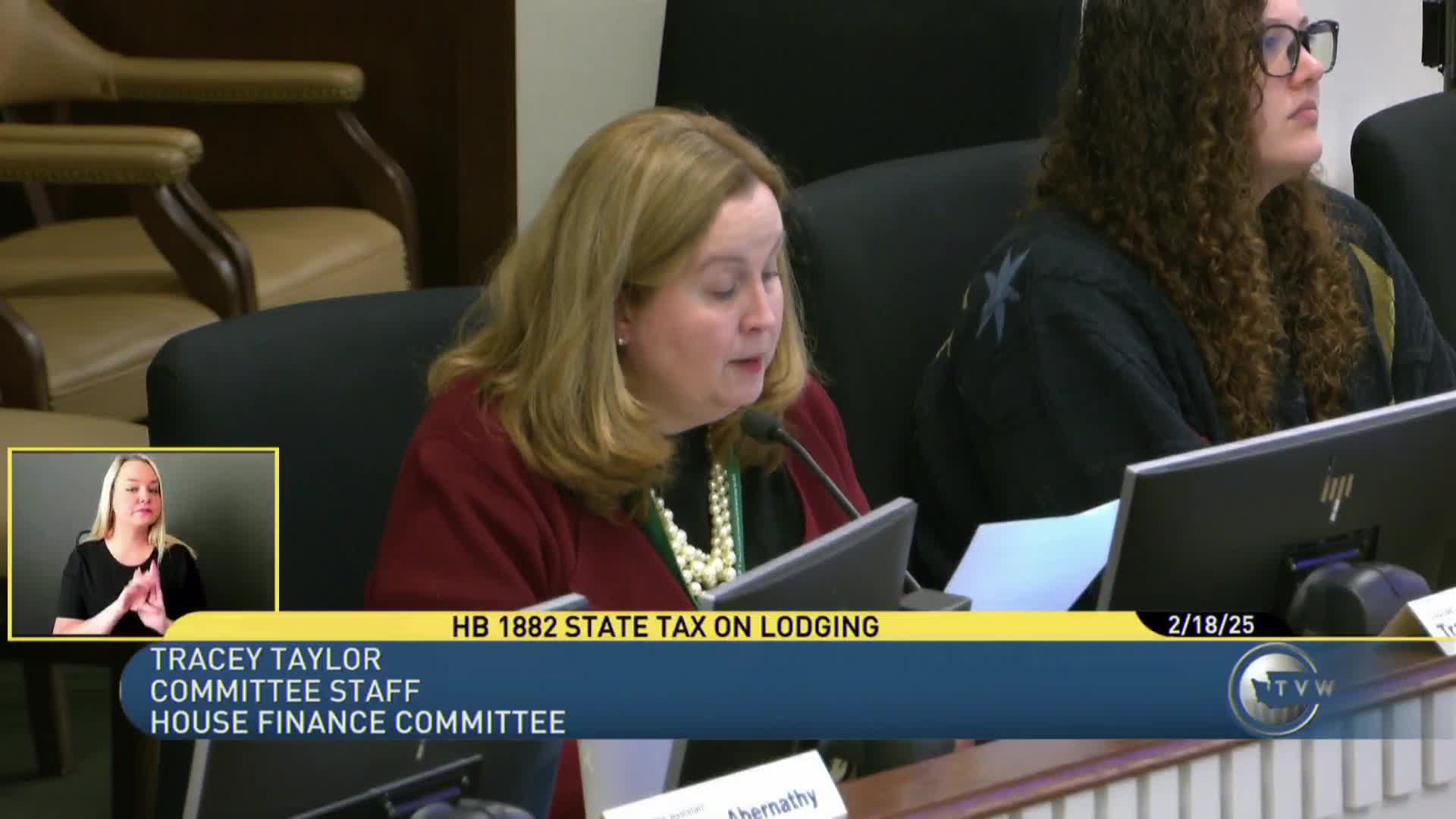

Sponsor pitches temporary 2% lodging tax to fund tourism and trafficking services for 2026 World Cup; DOR provides revenue estimate