Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

Budget proposes directing opioid settlement and other off-budget funds to maintain programs; committee seeks transparency

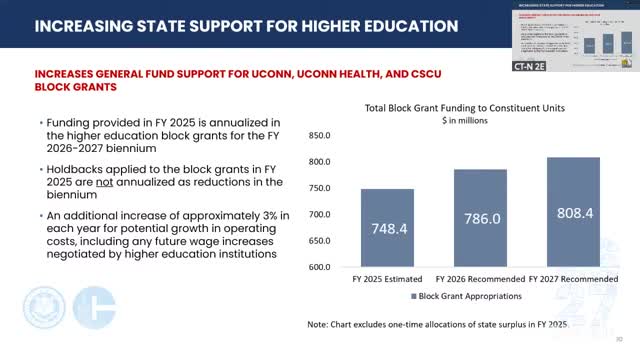

Administration holds higher-education block grants steady with modest growth but trims one-time federal support

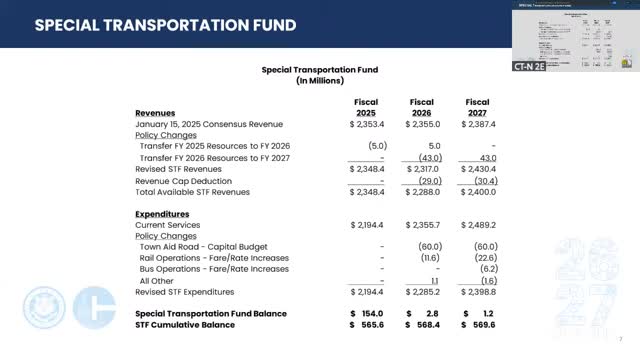

Budget would move Town Aid Road to capital budget and raise transit fares to help defray growing costs

Governor proposes universal preschool endowment seeded by surplus; OEC may draw up to 10% annually

Administration cites $300M Medicaid deficiency; proposes targeted coverage and rate changes