Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

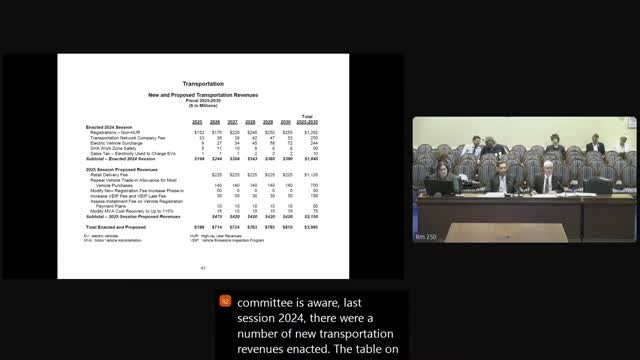

Transportation: proposed retail delivery fee, vehicle tax changes and new TTF revenues to boost MTA but leave some road needs unfunded

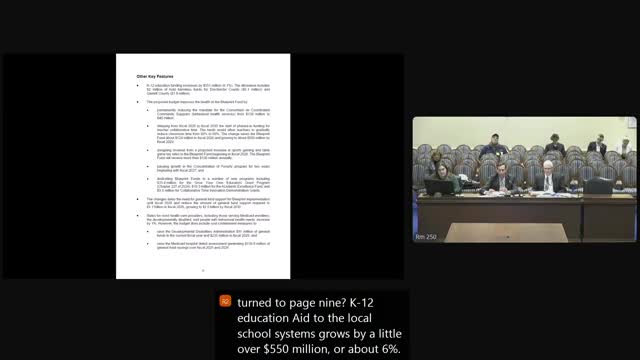

Budget briefing: governor seeks pauses and caps in Blueprint rollout and shifts $144 million in costs to local governments

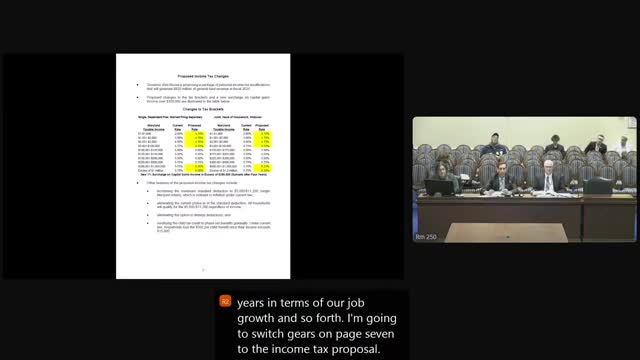

Governor's income tax overhaul would raise top rates, double standard deduction and add 1% capital‑gains surcharge for four years