Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

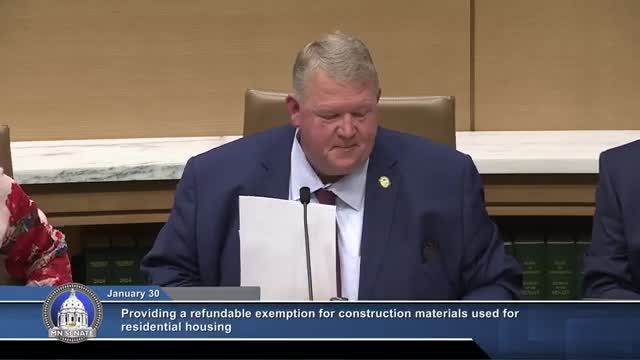

Informational hearing: senator pitches sales‑tax exemption on building materials to lower new‑home costs

Committee advances bill to waive county recording fees for removing racial/restrictive covenants

Committee weighs background‑check requirement for nonresident tenant organizers; cap added and bill tabled