Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

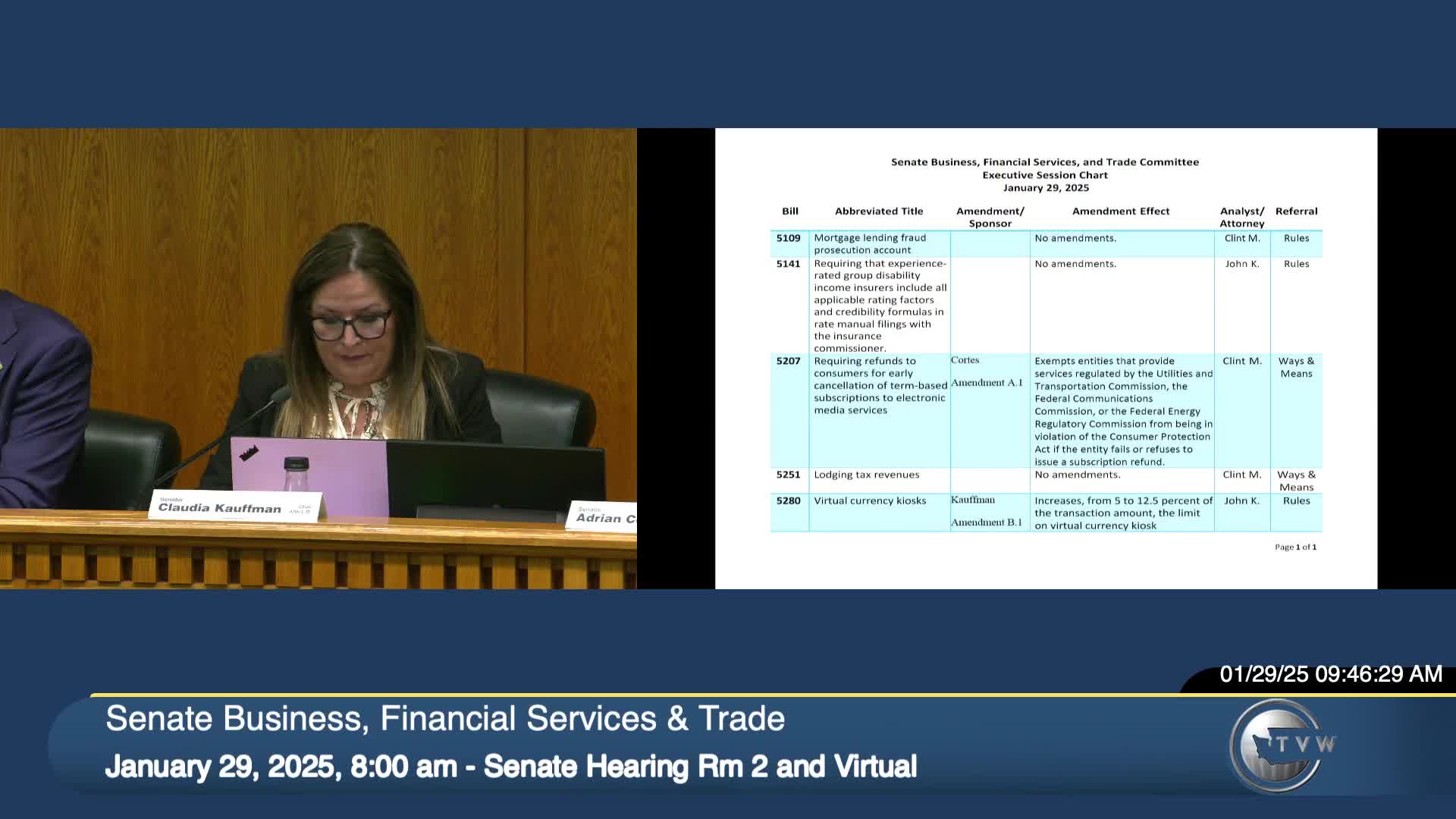

Committee advances multiple bills in executive session; votes recorded for several measures

Tourism industry pushes bill to create self‑assessment advisory process to fund statewide marketing and visitor management

Bill would centralize fire‑loss reporting at Insurance Commissioner, add immediacy and confidentiality provisions

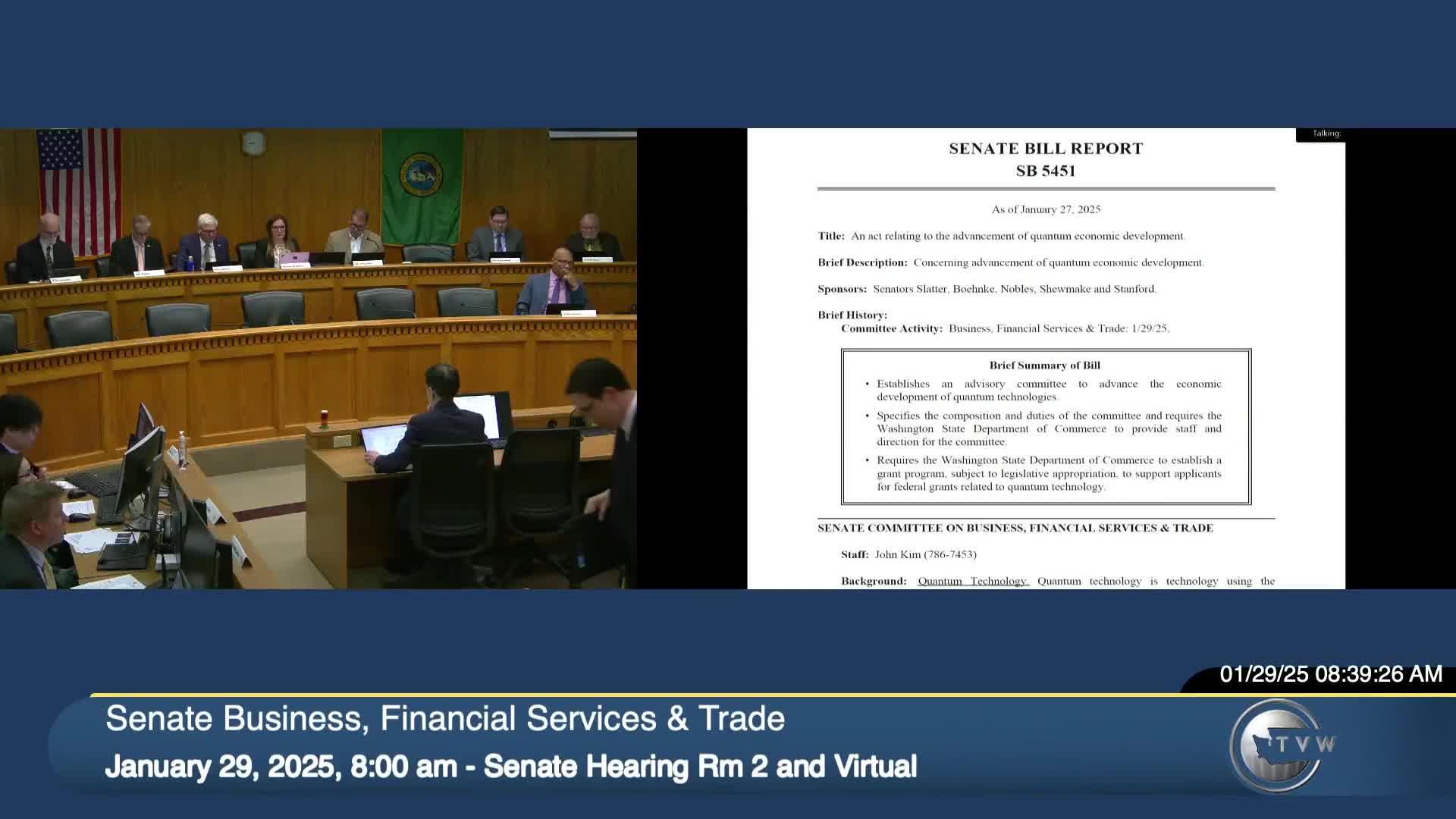

Senate hears bill to create Washington advisory committee and grant program for quantum economic development