Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

Legislative analysts: property‑tax relief costs rose from $18B to roughly $22.7B due to hold‑harmless rules and valuation assumptions

Comptroller Hager: Texas has $19.46 billion available for general purpose spending; ESF cap will alter future transfers

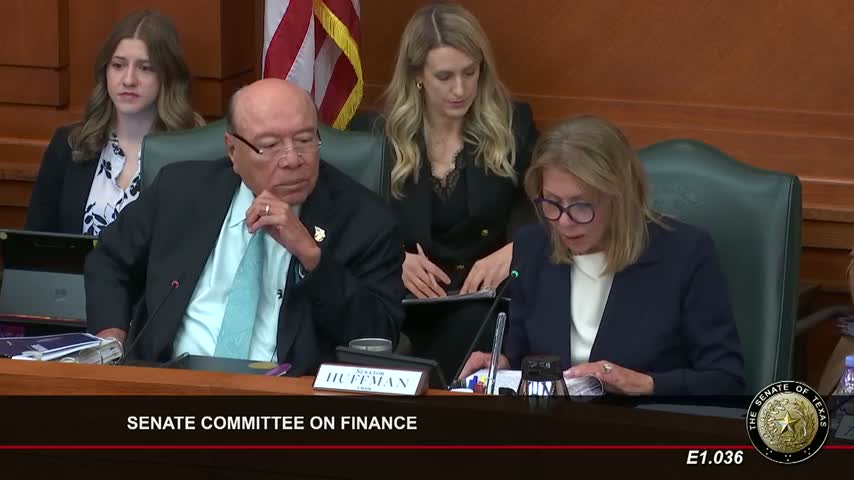

Senate Finance chair unveils Senate Bill 1: $33.29 billion all‑funds base budget with $3 billion new property‑tax relief