Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

Bill would let state employees bargain for supplemental early-retirement medical benefits; corrections staff urged passage

Committee adopts substitute and forwards paid family and medical leave change for dock workers to rules

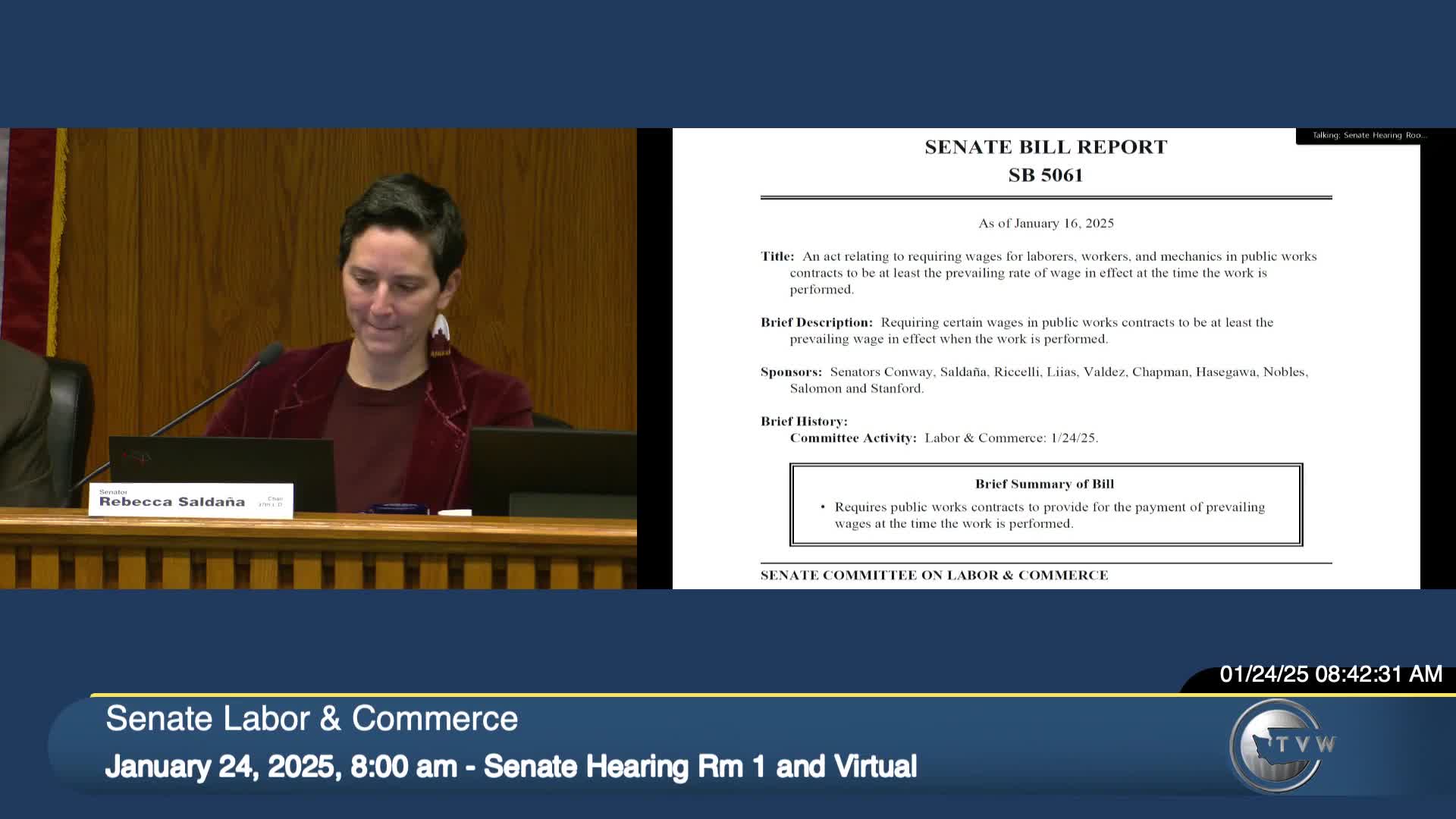

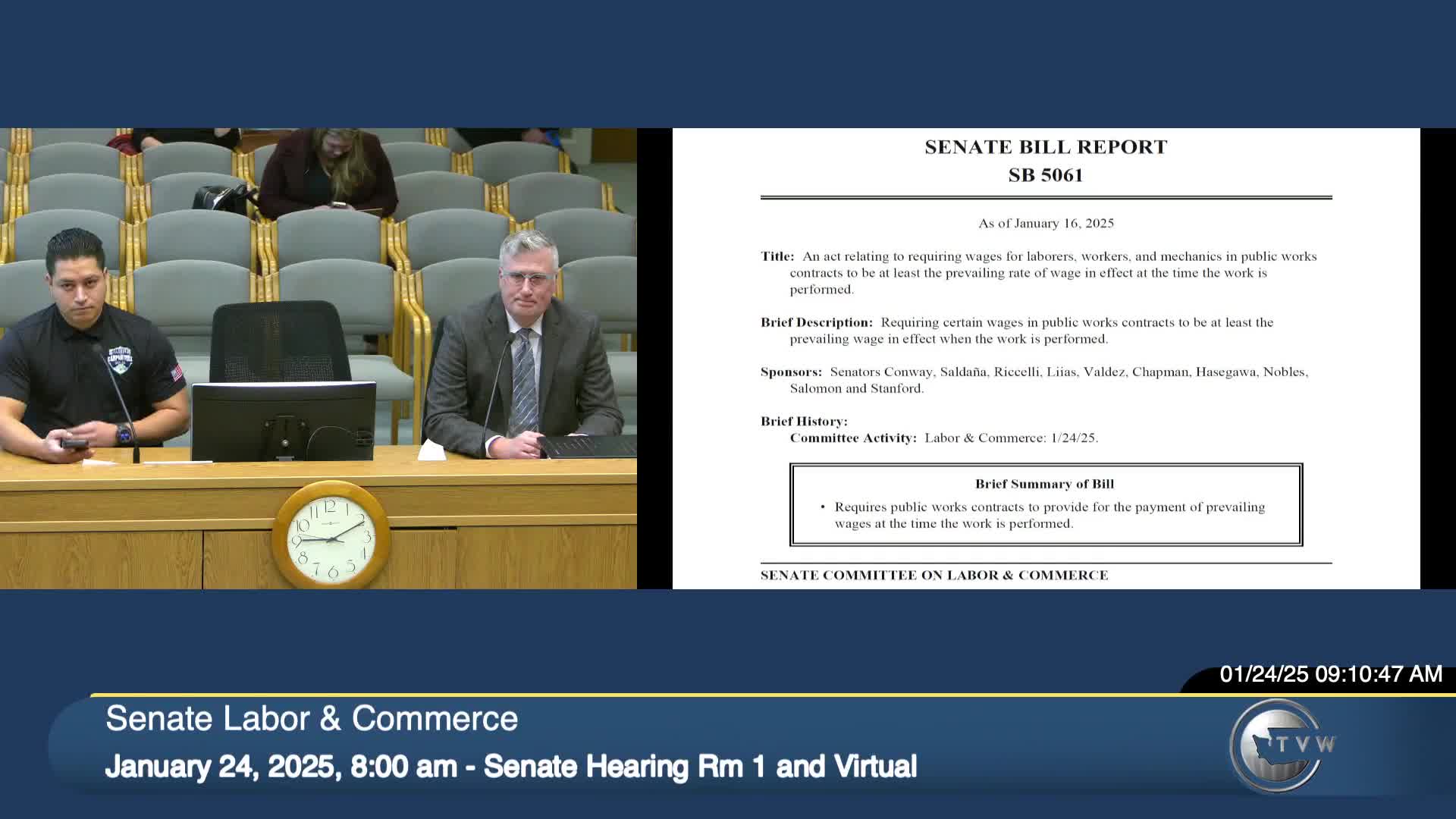

Bill would make public‑works pay follow current prevailing wages during project performance; supporters say it reduces turnover, opponents warn of bid unpredict

Committee hears bill to restore interest arbitration eligibility for WMS employees at DOC