Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

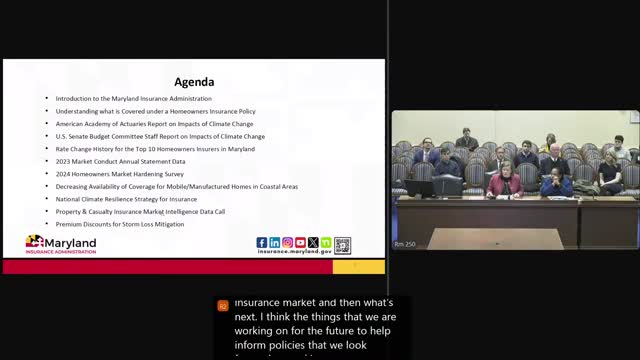

Industry and consumer groups offer different fixes: trade associations cite reinsurance and claims costs; advocates and a risk scholar propose regulation and a

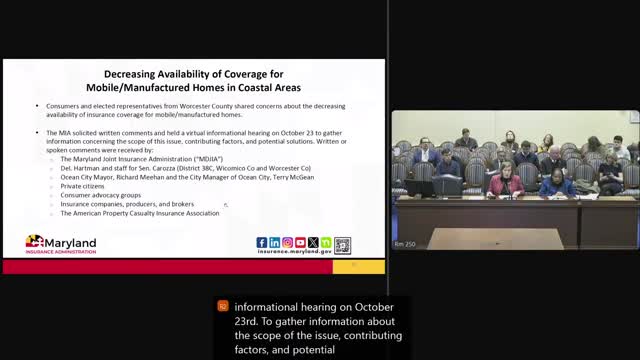

Ocean City and Worcester County residents report lack of replacement‑value insurance for older manufactured and mobile homes