Article not found

This article is no longer available. But don't worry—we've gathered other articles that discuss the same topic.

RSQE projects modest U.S. growth and gradual Michigan recovery; warns tariffs, policy uncertainty could alter path

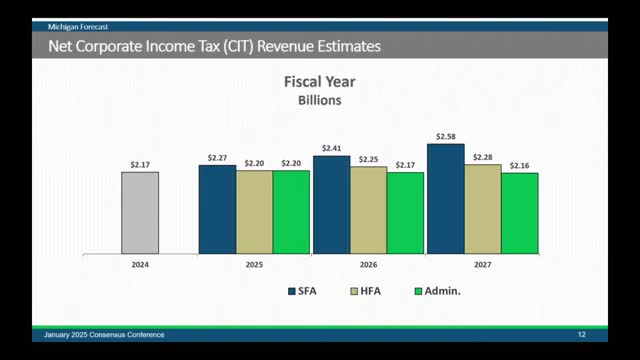

CREC adopts revised revenue estimates; forecasters project modest growth, cite volatility in a few tax streams

CREC adopts K‑12 pupil membership counts with minimal revisions; state projects continued gradual enrollment decline