Tax Burden Rises for Homeowners Despite Property Value Drop

August 30, 2024 | SCHERTZ-CIBOLO-U CITY ISD, School Districts, Texas

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

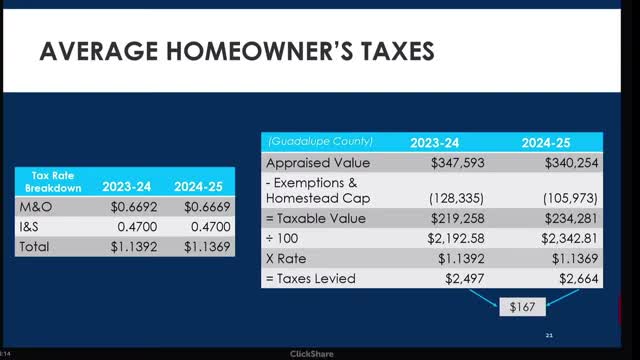

In a recent government meeting, officials discussed significant changes in property tax assessments and their implications for homeowners in Guadalupe County. The average appraised value of homes in the county has decreased by $7,000; however, the taxable value has risen by nearly $15,000. This discrepancy is attributed to the diminishing effects of the homestead cap, which limits how much property taxes can increase annually.

As a result of these changes, homeowners can expect an increase of approximately $167 in their tax burden for the upcoming year, translating to about $14 per month. This follows a previous year where homeowners experienced an average reduction of around $800 in their tax bills.

Officials explained that the rise in taxable value is not due to an increase in tax rates but rather a correction in the market value assessments. They noted that many homes had previously seen significant increases in market value, which were not fully reflected in taxable values due to legal caps. As these caps are utilized, the taxable values are catching up, leading to the current situation.

Additionally, the meeting highlighted the financial benefits of recent fiscal strategies, which have saved taxpayers approximately $11 million over the past three years by accelerating bond payments. This approach has allowed the district to manage its debt more effectively without extending payment periods to the typical 30 years.

Despite the lack of public comments during the meeting, officials expressed their commitment to transparency and encouraged community engagement in future discussions. The meeting concluded with a reminder of the importance of these financial decisions for the long-term fiscal health of the community.

As a result of these changes, homeowners can expect an increase of approximately $167 in their tax burden for the upcoming year, translating to about $14 per month. This follows a previous year where homeowners experienced an average reduction of around $800 in their tax bills.

Officials explained that the rise in taxable value is not due to an increase in tax rates but rather a correction in the market value assessments. They noted that many homes had previously seen significant increases in market value, which were not fully reflected in taxable values due to legal caps. As these caps are utilized, the taxable values are catching up, leading to the current situation.

Additionally, the meeting highlighted the financial benefits of recent fiscal strategies, which have saved taxpayers approximately $11 million over the past three years by accelerating bond payments. This approach has allowed the district to manage its debt more effectively without extending payment periods to the typical 30 years.

Despite the lack of public comments during the meeting, officials expressed their commitment to transparency and encouraged community engagement in future discussions. The meeting concluded with a reminder of the importance of these financial decisions for the long-term fiscal health of the community.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting