Property tax changes spark debate over school funding

September 05, 2024 | Madison County Schools, School Districts, Alabama

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

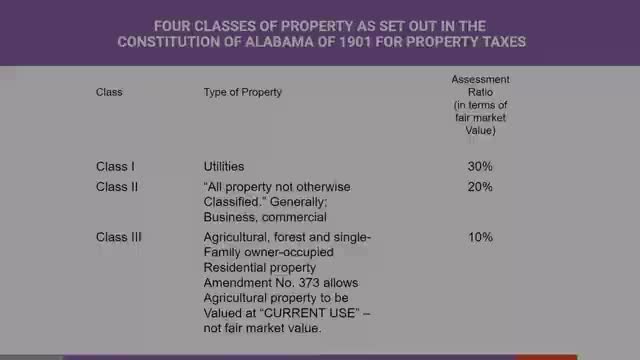

In a recent government meeting, officials discussed the implications of property tax assessments and revenue generation for local school systems. The focus was primarily on class 3 residential properties, which are assessed at 10% and represent a significant source of revenue. The meeting highlighted the millage rates for three school districts, with Madison County's rate set at 16 mills, generating approximately $240 per $150,000 home for the school system.

Officials noted that property tax increases have averaged between 14% to 18% over the past two years, with projections indicating a potential increase of $7.3 million for the upcoming fiscal year. However, a 7% cap on assessment increases will take effect for the 2024-2025 fiscal year, which may reduce future tax revenue growth. This cap does not apply to new constructions or improvements, leading to predictions that property tax increases could be halved moving forward.

Sales tax revenues were also a topic of discussion, with officials reporting stable collections despite economic fluctuations. The county has seen a significant increase in revenue from the Simplified Sales and Use Tax (SSUT) related to online sales, particularly from Amazon, which has grown from $1 million in its first year to $12 million annually. However, local school systems do not receive any portion of these funds, raising concerns about equitable funding distribution.

The meeting concluded with a breakdown of local revenue allocations, revealing that Huntsville City receives approximately 45% of countywide taxes, while Madison County and Madison City receive 38% and 17%, respectively. This disparity in funding per student was noted, with Huntsville City operating with more than double the local revenues compared to Madison City, despite having a smaller student population. The discussions underscored ongoing challenges in balancing property tax assessments, sales tax revenues, and equitable funding for education across the districts.

Officials noted that property tax increases have averaged between 14% to 18% over the past two years, with projections indicating a potential increase of $7.3 million for the upcoming fiscal year. However, a 7% cap on assessment increases will take effect for the 2024-2025 fiscal year, which may reduce future tax revenue growth. This cap does not apply to new constructions or improvements, leading to predictions that property tax increases could be halved moving forward.

Sales tax revenues were also a topic of discussion, with officials reporting stable collections despite economic fluctuations. The county has seen a significant increase in revenue from the Simplified Sales and Use Tax (SSUT) related to online sales, particularly from Amazon, which has grown from $1 million in its first year to $12 million annually. However, local school systems do not receive any portion of these funds, raising concerns about equitable funding distribution.

The meeting concluded with a breakdown of local revenue allocations, revealing that Huntsville City receives approximately 45% of countywide taxes, while Madison County and Madison City receive 38% and 17%, respectively. This disparity in funding per student was noted, with Huntsville City operating with more than double the local revenues compared to Madison City, despite having a smaller student population. The discussions underscored ongoing challenges in balancing property tax assessments, sales tax revenues, and equitable funding for education across the districts.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting