Tax adjustments spark debate over property value impacts

August 09, 2024 | WACO ISD, School Districts, Texas

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

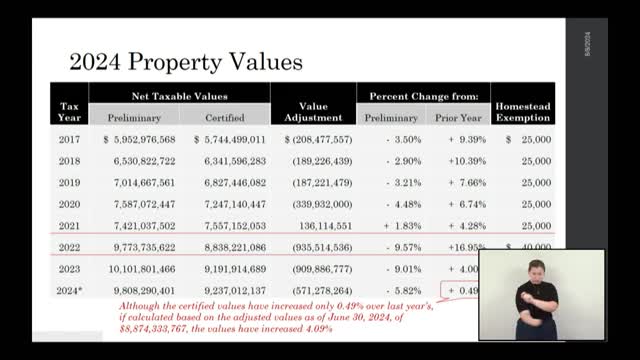

In a recent government meeting, officials discussed significant adjustments to the local tax levy, revealing a downward adjustment of $7.7 million. This adjustment has implications for the overall tax collection strategy, as it reflects a 0.49% increase compared to the previous year’s certified values, while adjusted values indicate a more substantial 1.49% increase.

The meeting highlighted a new market value of $249 million and a certified taxable value of $212 million, alongside a loss of $30 million in exemption value. Notably, the number of homesteads increased from 14,243 to 14,631, suggesting a rise in residents filing for the $100,000 homestead exemption. The average market value of residences also saw an increase, rising from $231,937 to $240,714.

Tax collection figures were presented, showing total maintenance and operations (M&O) tax collections of $84.7 million against a levy of $86.8 million. The collection rate for the past year was reported at 97%, a decrease from 103% the previous year. Officials noted a cautious approach to future tax rates, opting for a conservative estimate of 98% to maintain a buffer in the debt service fund, which had been drawn down by 30%.

The meeting concluded with discussions on the compressed tax rate, which is limited to 0.6169, reflecting the state’s certified values and local appraisal growth of 0.49%. This careful management of tax rates and collections is aimed at ensuring fiscal stability in the face of fluctuating property values and exemptions.

The meeting highlighted a new market value of $249 million and a certified taxable value of $212 million, alongside a loss of $30 million in exemption value. Notably, the number of homesteads increased from 14,243 to 14,631, suggesting a rise in residents filing for the $100,000 homestead exemption. The average market value of residences also saw an increase, rising from $231,937 to $240,714.

Tax collection figures were presented, showing total maintenance and operations (M&O) tax collections of $84.7 million against a levy of $86.8 million. The collection rate for the past year was reported at 97%, a decrease from 103% the previous year. Officials noted a cautious approach to future tax rates, opting for a conservative estimate of 98% to maintain a buffer in the debt service fund, which had been drawn down by 30%.

The meeting concluded with discussions on the compressed tax rate, which is limited to 0.6169, reflecting the state’s certified values and local appraisal growth of 0.49%. This careful management of tax rates and collections is aimed at ensuring fiscal stability in the face of fluctuating property values and exemptions.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting