Residents Face Flood Insurance Crisis Amid New Mapping Changes

September 14, 2024 | Broward County, Florida

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

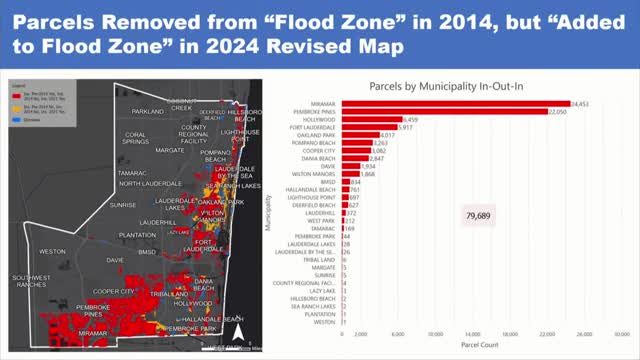

In a recent government meeting, officials discussed significant changes to floodplain mapping in the county, revealing that nearly 80,000 properties previously removed from the Special Flood Hazard Area are now being reinstated. This shift has prompted numerous residents to receive notifications from their banks requiring flood insurance, following the new maps that took effect in July.

The meeting highlighted the importance of understanding the implications of these changes. Residents who receive such notifications are advised to check for a Letter of Map Amendment (LOMA), which can exempt them from the flood insurance requirement if their property is classified in a lower-risk zone. To obtain a LOMA, homeowners need an elevation certificate and must complete specific forms for FEMA, with assistance available from local floodplain managers.

Officials acknowledged the growing concern over flooding risks, particularly due to increased rainfall attributed to climate change. One board member emphasized that the frequency of severe weather events suggests that the traditional understanding of a \"1 in 100 year\" flood risk may no longer be accurate. This has led to heightened awareness among residents regarding the necessity of flood insurance, regardless of their property's designated flood zone.

The discussion also touched on the broader implications of climate change on local infrastructure, with officials noting that the county's drainage systems are becoming less effective. As a proactive measure, one board member humorously suggested that residents consider investing in \"arks and houseboats\" as a means of adapting to the changing climate and increased flooding risks.

The meeting concluded without public comments, but the urgency of addressing flood insurance and preparedness remains a pressing issue for the community.

The meeting highlighted the importance of understanding the implications of these changes. Residents who receive such notifications are advised to check for a Letter of Map Amendment (LOMA), which can exempt them from the flood insurance requirement if their property is classified in a lower-risk zone. To obtain a LOMA, homeowners need an elevation certificate and must complete specific forms for FEMA, with assistance available from local floodplain managers.

Officials acknowledged the growing concern over flooding risks, particularly due to increased rainfall attributed to climate change. One board member emphasized that the frequency of severe weather events suggests that the traditional understanding of a \"1 in 100 year\" flood risk may no longer be accurate. This has led to heightened awareness among residents regarding the necessity of flood insurance, regardless of their property's designated flood zone.

The discussion also touched on the broader implications of climate change on local infrastructure, with officials noting that the county's drainage systems are becoming less effective. As a proactive measure, one board member humorously suggested that residents consider investing in \"arks and houseboats\" as a means of adapting to the changing climate and increased flooding risks.

The meeting concluded without public comments, but the urgency of addressing flood insurance and preparedness remains a pressing issue for the community.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting