SEC Faces Scrutiny Over Confusing Crypto Regulations

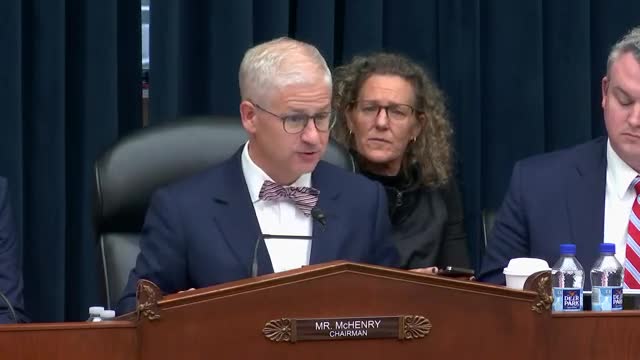

September 25, 2024 | Financial Services: House Committee, Standing Committees - House & Senate, Congressional Hearings Compilation

This article was created by AI summarizing key points discussed. AI makes mistakes, so for full details and context, please refer to the video of the full meeting. Please report any errors so we can fix them. Report an error »

During a recent government meeting, Chair Gary Gensler of the Securities and Exchange Commission (SEC) faced scrutiny regarding the regulatory treatment of ether, the native token of the Ethereum blockchain. The discussion was prompted by a letter from the agriculture and financial services committee expressing concerns over the SEC's inconsistent terminology surrounding digital assets.

Gensler emphasized that the classification of any asset as a security hinges on specific facts and circumstances, referencing the Supreme Court's Howey test, which determines whether an investment contract is being offered to the public. He acknowledged the existence of various terms such as \"crypto tokens,\" \"crypto security tokens,\" and \"digital asset securities,\" but maintained that the economic realities of the assets are more critical than the labels used.

Commissioner Hester Peirce joined the conversation, asserting that the SEC's use of multiple terms reflects a broader lack of regulatory clarity. She pointed out that the SEC's definitions can be legally imprecise, which complicates the understanding of whether a digital asset itself is a security or merely part of an investment contract. Peirce argued that this ambiguity has significant implications for the market, particularly concerning secondary sales of tokens.

The meeting highlighted the urgent need for clearer regulatory guidelines in the rapidly evolving landscape of digital assets, as stakeholders continue to seek definitive answers on the classification and treatment of cryptocurrencies.

Gensler emphasized that the classification of any asset as a security hinges on specific facts and circumstances, referencing the Supreme Court's Howey test, which determines whether an investment contract is being offered to the public. He acknowledged the existence of various terms such as \"crypto tokens,\" \"crypto security tokens,\" and \"digital asset securities,\" but maintained that the economic realities of the assets are more critical than the labels used.

Commissioner Hester Peirce joined the conversation, asserting that the SEC's use of multiple terms reflects a broader lack of regulatory clarity. She pointed out that the SEC's definitions can be legally imprecise, which complicates the understanding of whether a digital asset itself is a security or merely part of an investment contract. Peirce argued that this ambiguity has significant implications for the market, particularly concerning secondary sales of tokens.

The meeting highlighted the urgent need for clearer regulatory guidelines in the rapidly evolving landscape of digital assets, as stakeholders continue to seek definitive answers on the classification and treatment of cryptocurrencies.

View full meeting

This article is based on a recent meeting—watch the full video and explore the complete transcript for deeper insights into the discussion.

View full meeting